UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14-A14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for use of the Commission | |

| x | Definitive Proxy Statement | Only (as permitted by Rule 14(a)-6(e)(2)) | ||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

SEACOAST BANKING CORPORATION OF FLORIDA

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule, or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

April 9, 2014Proxy Statement

2017

TO THE SHAREHOLDERS OFSEACOAST BANKING CORPORATION OF FLORIDA:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders of Seacoast Banking Corporation of Florida, which will be held at the Wolf Technology Center, 2400 S.E. Salerno Road, Stuart, Florida, on Wednesday, May 21, 2014, at 3:00 P.M., Local Time.

Details regarding the business to be conducted at the meeting are described in the Notice of Internet Availability of Proxy Materials (“Notice”) you received in the mail and in this proxy statement. We have also made available a copy of our Annual Report on Form 10-K for the period year ended ending December 31, 2013 (“Annual Report”) which we encourage you to read. The Annual Report includes our audited financial statements and provides information about our business.

We have elected to provide access to our proxy materials over the internet under the Securities and Exchange Commission’s “Notice and Access” rules. We are continually focused on improving the way people connect with information, and believe that providing our proxy materials over the internet increases the ability of our shareholders to connect with the information they need, while reducing the environmental impact of our annual meeting. You may also request to receive a printed or emailed set of proxy materials. If you want more information, please see the “Questions and Answers” section of this proxy statement.

Your vote is important. Whether or not you plan to attend the meeting, we hope you will vote as soon as possible. You may vote over the internet, as well as by telephone. You also may vote your shares by requesting a paper proxy card and completing, signing and returning it by mail. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice you received in the mail. By voting prior to the meeting, you will help us ensure that we have a quorum and that your preferences will be expressed on the matters that are being considered. If you are able to attend the meeting, you may vote your shares in person, even if you have previously voted by another means by revoking your proxy vote at any time prior to its exercise. .

Thank you for your ongoing support. We look forward to your participation in our annual meeting.

| |

| 815 Colorado Avenue |

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERSTO BE HELD ON MAY 21, 2014

Notice is hereby given that the 2014 Annual Meeting of Shareholders of Thursday, May 25, 2017

3:30 p.m. Eastern Time

Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) will be heldhold its 2017 Annual Meeting of Shareholders at the Wolf TechnologyFounder’s Room, Orlando Science Center, 2400 S.E. Salerno Road, Stuart,777 E. Princeton Street, Orlando, Florida, 32803, on Wednesday,Thursday, May 21, 2014,25, 2017 at 3:00 P.M., Local Time (collectively, with any adjournments or postponements, the “Annual Meeting”), for30 p.m. Eastern Time.

ITEMS OF BUSINESS

To vote on the following purposes:proposals:

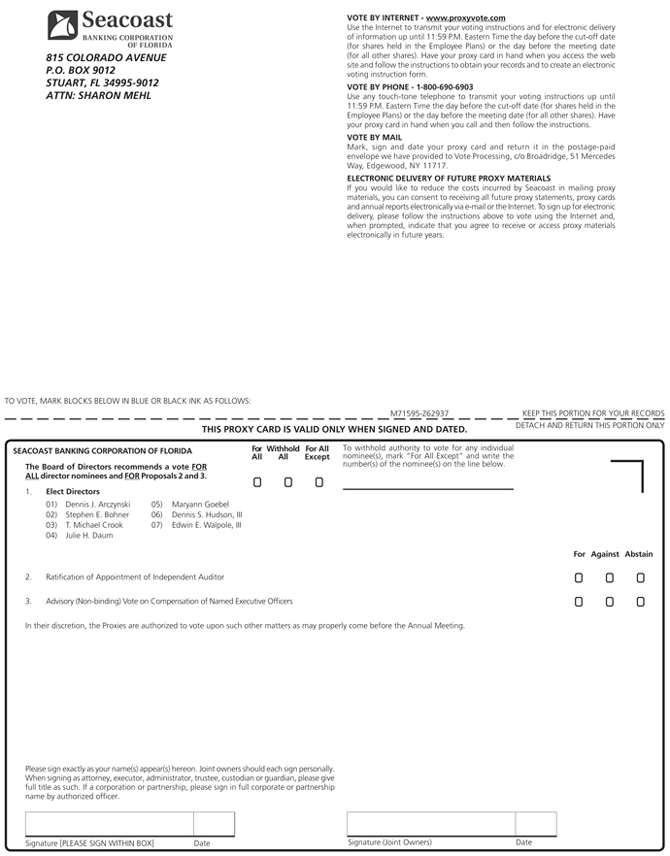

| 1. | Election of Directors.To |

| 2. | Ratification of Appointment of Independent Auditor.To ratify the appointment of |

| 3. | Advisory (Non-binding) Vote on Compensation of Named Executive Officers.To |

| 4. | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The Proxy Statement explains these proposals in greater detail. We urge you to read these materials carefully.RECORD DATE

Only shareholdersYou can vote if you were a shareholder of record and beneficial owners of the Company’s Common Stock as ofon the close of business onMarch 20, 2014 are entitled to noticeon March 23, 2017, with is the record date for the annual meeting. This Notice of and to vote at, the 2017 Annual Meeting or any adjournments thereof. All shareholders, whether or not they expect to attendof Shareholders and the Annual Meeting in person,accompanying proxy statement are requested to votesent by internet or telephone, or by requesting a paper proxy card and completing, signing and returning it by mail.order of the Board of Directors.

| |

| Dennis S. Hudson, III | |

| Chairman & Chief Executive Officer |

April 9, 20146, 2017

TABLE OF

CONTENTS

Table of Contents

| 1 | ||

| | ||

| PROXY SUMMARY | ||

| 3 | ||

| 3 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| Board and Governance Highlights | ||

| Board Composition | ||

| Our Corporate Governance Framework | 14 | |

| | ||

| CORPORATE GOVERNANCE AT SEACOAST | 15 | |

| Corporate Governance Principles and Practices | 15 | |

| Governance Policies | 15 | |

| Board Independence | 15 | |

| Board Leadership Structure | 16 | |

| Non-Management Executive | 19 | |

| Committee Structure and Other Matters | 19 | |

| 20 | ||

| 22 | ||

| 24 | ||

| 26 | ||

| Director Nomination Process | ||

| 29 | ||

| 29 | ||

| Board Meeting Attendance | 29 | |

| Annual Meeting Attendance | 29 | |

| Board Committees | 30 | |

| The Board’s Role in Strategy and Risk Oversight | 33 | |

| Audit Committee Report | 34 | |

| i |

| ii |

PROXY STATEMENTFORANNUAL MEETING OF SHAREHOLDERSOF SEACOAST BANKING CORPORATION OF FLORIDAMAY 21, 2014

| GENERAL INFORMATION |

Date, Time and Place:Thursday, May 25, 2017, at 3:30 P.M. Eastern Time at the Founder’s Room, OrlandoScience Center, 777 E. Princeton Street, Orlando, Florida 32803. The Board of DirectorsAnnual Meeting shall be referred to herein as the “Meeting” or the “Annual Meeting.”

Street Name Holders:If your shares of Seacoast Banking Corporationcommon stock are held in a bank, brokerage or otherinstitutional account (which is commonly referred to as “street name”), you are a beneficial owner of Florida, a Florida corporation (“Seacoast” orthese shares, but you are not the “Company”) is soliciting proxiesrecord holder. If your shares are held in street name, you are invited to be votedattend the Annual Meeting; however, to vote your shares in person at the Annual Meetingmeeting, you must request and obtain a power of Shareholdersattorney or other authority from the bank, broker or other nominee who holds your shares and bring it with you to be held on Wednesday, May 21, 2014, at 3:00 P.M. Local Time (collectively,submit with any adjournments or postponements, the “Annual Meeting”)your ballot at the Wolf Technology Center, 2400 S.E. Salerno Road, Stuart, Floridameeting. In addition, you may vote your shares before the meeting by phone or over the Internet by following the instructions set forth below or, if you received a voting instruction form from your brokerage firm, by mail by completing, signing and returning the form you received. Your voting instruction form will set forth whether Internet or telephone voting is available to you. Although most brokers and nominees offer telephone and Internet voting, availability and specific processes will depend on their voting arrangements. We encourage you to record your vote through the Internet if such process is available to you.

How to View Proxy Materials Online

Important Notice Regarding the Availability of Proxy Materials for the purposes set forth in2017 Shareholder Meeting

Our 2017 Proxy Statement and the attached Notice of Meeting. On or about April 9, 2014, the notice of meeting, this proxy statement, Seacoast’s Annual Report on Form 10-K for the period year ended December 31, 2013 (“Annual Report”),which includes our financial statements for the fiscal year ended December 31, 2013, and a proxy card or voting instruction card (collectively,2016 (referred to collectively herein as the “proxy materials”) are first being made available for review online and paper copies sent to each shareholder who has requested such materials.at: www.proxyvote.com or at www.seacoastbanking.com/GenPage.aspx?IID=100425&GKP=325642.

QUESTIONS AND ANSWERS ABOUT THE PROXY SOLICITATION MATERIALS

AND THE PROXY SOLICITATION

Proxy Materials

Q: Why am I receiving these proxy materials?

A: Our Board of Directors has made these materials available to you on the internet or, at your request, has delivered printed proxy materials to you, because on March 20, 2014, the record date set for the Annual Meeting (the “Record Date”), you owned shares of Seacoast’s common stock, $0.10 par value (“Common Stock”). Only holders of record of our Common Stock at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. Each holder of Common Stock is entitled to one vote for each share of Common Stock owned as of the Record Date. As of the Record Date, there were 25,985,761 shares of Common Stock issued and outstanding.

As a shareholder, you are invited to attend the Annual Meeting and are requested to vote on the proposals summarized below under “What matters will be voted on at the Annual Meeting” and described in greater detail elsewhere in this proxy statement. Seacoast’s Board of Directors knows of no other business that will be presented for consideration at the Annual Meeting other than the matters described in this proxy statement.

Q: What is included in the proxy materials?

A: The proxy materials include:

Q: What information is contained in this proxy statement?

A: This proxy statement describes the matters that will be presented for consideration by shareholders at the Annual Meeting, the voting process, the compensation of our directors and certain of our executive officers, corporate governance, and certain other required information. It also gives you background information concerning the proposals to assist you in making an informed decision. Please read it carefully.

Q: Why did I receive a “Notice of the Internet Availability of Proxy Materials”, but no proxy materials?

A: We have furnished our proxy materialsmailed to certain shareholders via thea notice of internet under the “Notice and Access” method permitted by the Securities and Exchange Commission (the “SEC”). Therefore, unless you request hard copies, you will not receive printed copiesavailability of the proxy materials. Instead,the Notice of Internet Availability of Proxy Materials (the “Notice”), which was mailed to most of our shareholdersmaterials on or about April 9, 2014, instructs you as to6, 2017. This notice contains instructions on how to access and review all of the proxy materials on the internet. The Noticenotice also contains instructions on how to submit your proxy on the internet or by phone, or, if you prefer, to obtain a paper or email copy of the proxy materials.

This process provides a convenient and timely method for shareholders to obtain the proxy materials and vote, reduces the printing and mailing expenses paid by the Company, and reduces the environmental impact of producing the proxy materials.

Q: How can I access the proxy materials over the internet?HOW TO CAST YOUR VOTE

The Notice, proxy card or voting instruction card will contain instructionsYou may vote common shares that you owned as of the close of business on how to:

Our proxy materials are also available on our Investor Relations website at:Meeting.

https://www.snl.com/IRWebLinkX/GenPage.aspx?IID=100425&GKP=210302

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will conserve natural resources. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Q: Will the Company use the Notice and Access method to furnish proxy materials to its shareholders in the future?

A: The Company may choose to continue to use the Notice and Access method to furnish proxy materials to its shareholders in the future. By reducing the amount of materials that the Company is required to print and mail, this method provides an opportunity for cost savings as well as conservation of natural resources. The Company will evaluate the cost savings, as well as the possible impact on shareholder participation, as it considers how to furnish proxy materials to our shareholders in the future.

Q: What if I prefer to receive paper or email copies of the materials?

A: If you prefer to receive paper or email copies of the materials, you can still do so. You may request a paper copy of the materials by (i) calling 1-800-579-1639; (ii) sending an e-mail to sendmaterial@proxyvote.com; or (iii) logging ontowww.ProxyVote.com. There is no charge to receive the materials by mail or email. If requesting material by e-mail, please send a blank e-mail with the 12 digit control number (located on the Notice) in the subject line.

The Company must provide paper copies via first class mail to any shareholder who, after receiving the Notice, nevertheless requests paper copies. Even if you do not request paper copies now, you will still have the right to request delivery of a free set of proxy materials upon receipt of any notice in the future. Because first class postage is significantly more expensive than bulk mail rates and because each such request must be processed on an individual basis, the cost of responding to a single request for paper copies is likely to be significantly greater than the per shareholder cost the Company previously incurred in delivering proxy materials in bulk. Therefore, requests for paper copies could undermine or eliminate expected cost savings associated with our decision to use the Notice and Access method of furnishing proxy materials.

By developing a database of shareholders who would prefer to continue receiving paper copies of proxy materials, the Company will be able to use the full set delivery option for these shareholders, while using the Notice and Access option for other shareholders. We believe this will significantly reduce the number of requests for paper copies that the Company will need to process on an individual basis going forward and will position the Company to better capture cost savings should we continue to use the Notice and Access method in the future. We appreciate your assistance in helping us develop this database.

Voting Information

Q: What matters will be voted on at the Annual Meeting?

A: You are being asked to vote on three proposals summarized as follows:

These matters are more fully described in this proxy statement.

Q: How do I vote (shareholder of record)?

A: You are a shareholder of record if your shares of Common Stock are held in your name on the Record Date. If you are a beneficial owner of Common Stock held by a broker, bank or other nominee (which is commonly referred to as “street name”), please see the instructions in the following question.

Instructions for voting are found on the Notice and proxy card. After reviewing these instructions, please submit your proxy via telephone or through the Internet, or by completing and returning a written proxy card. By submitting your proxy, you authorize the individuals named in it to represent you and vote your shares at the Annual Meeting in accordance with your instructions. Your vote is important, and your shares can only be voted if you are present in personimportant. Whether or represented by proxy at the Annual Meeting.To ensure your representation at the Annual Meeting, we recommend you vote by proxy even ifnot you plan to attend the Annual Meeting.Meeting, we hope you will vote as soon as possible. Please vote promptly using onereview the instructions on each of your voting options described in this proxy statement, as well as in the proxy delivery ornotice you received in the mail. By voting methods indicatedprior to the Meeting, you will help ensure that we have a quorum and that your preferences will be expressed on the Notice or proxy card.You canmatters that are being considered. If you are able to attend the Meeting, you may vote your shares in person, at the Annual Meeting even if you have previously provided a proxyvoted by another means by revoking theyour proxy vote at any time prior to its exercise.exercise, pursuant to the procedures specified in “Revocation of Proxies.”

| 1 |

You may vote by any of the following methods:

| BY TELEPHONE: You can vote by calling the number on your proxy card or voting instruction form, or provided on the website listed on your notice. |

| BY INTERNET: You can vote online atwww.proxyvote.com |

| BY MAIL: You also may vote your shares by requesting a paper proxy card and completing, signing and returning it by mail in the envelope provided. |

| IN PERSON: You can vote in person at the Annual Meeting. If you hold your shares in street name, you must obtain a proxy from the record holder in order to vote in person. |

For telephone and internet voting, you will need the 16-digit control number included in your notice, on your proxy card or in the voting instructions that accompanied your proxy materials.

If you vote by proxy, but do not provide voting instructions, yourFor shares represented by the proxy will be voted as recommended by our Board of Directors as indicated below under “What is the recommendation of the Board of Directors with regard to each proposal?” If any other matters are properly presented at the Annual Meeting for action, the persons named and acting as proxy will have the discretion to vote for you on these matters in accordance with their best judgment. We do not currently expect that any other matters will be properly presented for action at the Annual Meeting.

Q: What if my shares are held in street name?

A: If you are a beneficial owner and a broker, bank or other nominee is the record holder (which is commonly referred to as “street name”), then you received the Notice or proxy materials from the record holder. You have the right to direct your broker or nominee how to vote your shares, and such broker or other nominee is required to vote the shares in accordance with your instructions. Your broker or nominee should have given you instructions for you to provide direction on how to vote your shares. It will then be the record holder’s responsibility to vote your shares for you in the manner you direct.

Under the rules of various securities exchanges, brokers and other record holders may generally vote on discretionary or routine matters, but cannot vote on non-routine or non-discretionary matters, such as the election of directors, unless they have received voting instructions from the person for whom they are holding shares. Proposals 1 and 3 are considered non-routine matters, and cannot be voted on by your broker without your instructions. We therefore encourage you to provide directions to your broker as to how you want your shares voted on all matters to be brought before the Annual Meeting. You should do this by carefully following the instructions your broker gives you.

If your shares are held in street name, you are invited to attend the Annual Meeting; however, you may not vote your shares of Common Stock held in street name in person at the Annual Meeting unless you request and obtain a power of attorney or other authority from your broker or other nominee who holds your shares and bring it to the Annual Meeting. Even if you plan to attend the Annual Meeting,employee plans, we ask that you vote in advance of the Annual Meeting in case your plans change.

Q: How will my shares of stock held in Seacoast’s Retirement Savings Plan or Employee Stock Purchase Plan be voted?

A: If you are a participant in Seacoast’s Retirement Savings Plan or Employee Stock Purchase Plan,must receive your voting instructions must be received byno later than 11:59 p.m. Eastern Time on May 15, 201418, 2017 (the “cut-off date”) to be counted. When your voting instructions are received byOtherwise, you may vote up until 11:59 P.M. Eastern Time the cut-off date, your sharesday before the meeting date.

| 2 |

| PROXY SUMMARY |

Our balanced growth strategy, which is focused on organic growth and completing value creating acquisitions in these plans will be votedgrowing markets, is delivering value for our shareholders.

In this section, we summarize 2016 performance highlights and other information contained elsewhere in this proxy statement. Please carefully review the information included throughout this proxy statement and as directed by you. For the shares in your account in Seacoast’s Retirement Savings Plan, if you do not submit your voting instructions by following the instructions on the Notice or proxy card, then the trustee of the Retirement Savings Plan will vote, or not vote, in its sole discretion, the shares of Common Stock in your account. For shares held in your accountprovided in the Employee Stock Purchase Plan, your shares will not be voted if2016 Annual Report on Form 10-K before you do not give voting instructions as to such shares by proxy.vote.

Q: How will my shares of Common Stock held in Seacoast’s Dividend Reinvestment and Stock Purchase Plan be voted?2016 Performance Highlights

A: If you are a participant in Seacoast’s Dividend Reinvestment and Stock Purchase Plan, follow the instructions on the Notice or proxy card to provide voting instructions to the Trustee. Shares held in your plan account will be combined and voted at the Annual Meeting in the same manner in which you voted those shares registered in your own name either by proxy or in person.

Q: What does it mean if I receive more than one proxy card or Notice?

A: It means that you have multiple holdings reflected inValue Creation for our stock transfer records and/or in accounts with brokers or other nominees. For example, you may hold some of your shares individually, some jointly with your spouse and some in trust for your children. Please follow the instructions on each Notice or proxy card to ensure that all of your shares are voted.

Q: What if I change my mind after I have voted?

A: If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:Shareholders

| · |

Also, please note that if you have voted through your broker, bank or other nominee and you wish to change your vote, you must follow the instructions received from such entity to change your vote.

Q: How many shares must be presentTotal return combines share price appreciation and dividends paid to hold the Annual Meeting?

A: To hold a vote on any proposal, a quorum must be present in person or by proxy at the Annual Meeting. A quorum is a majority ofshow the total votes entitledreturn to be cast by the holders of the outstanding shares of Common Stock as of the Record Date.

Shares are counted as present at the Annual Meeting if the shareholder either:expressed as an annualized percentage.

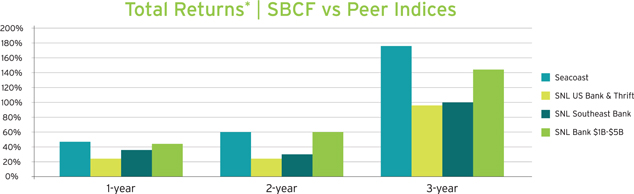

| · | Seacoast’s industry leading performance is |

| º | Our balanced growth strategy is working. We are meeting the needs of our customers and generating strong returns for shareholders. |

| º | We have a singular view of how we serve the customer, leveraging analytics to deepen and broaden relationships across all lines of business. |

| º | We have a deep and talented management team and experienced Board that we believe is able to execute our strategy and deliver shareholder value. |

| º | We have an enviable position in a strong Florida market. |

| º | We are only in the early innings of our balanced growth strategy and have a clear roadmap to continue to create value. |

| 3 |

| · |

| º | Revenues increased $35.3 million year over year to $177.4 million, reflecting significant franchise growth from $142.1 million in 2015. |

| º | Net income improved $7.1 million to $29.2 million from $22.1 million in 2015, and fully diluted earnings per share rose 18% to 78 cents a share from 66 cents in 2015. Adjusted net income1 surged 51% to $37.5 million from $24.9 million a year earlier, with adjusted diluted earnings per share rising 35 percent from 74 cents per share in 2015. |

| º | Households we serve have grown to 95,591 from 66,826 in 2013, with Orlando households now representing nearly 22% of Seacoast’s overall households served, up from 3.9% in 2013. |

| º | Loans climbed $723 million, or 34%, from year-ago levels, and adjusting for acquisitions, loan growth rose 18%, or $377 million. Our Accelerate commercial banking delivery platform, which we invested in four years ago, has become a significant part of our business. Also, we continue to maintain a very granular loan portfolio with modest commercial real estate exposure. |

| º | Our adjusted efficiency ratio1 improved to 60.8% for fourth quarter 2016 from 69.1 percent in the fourth quarter 2015, and our adjusted return on average assets1 increased to nearly 1 percent, at 0.99%, from 0.75% in the fourth quarter a year ago. Our adjusted return on tangible common equity1increased to 13.1% at year end vs. 8.5 percent in the fourth quarter of 2015. |

Our balanced growth strategy combines organic growth and select strategic M&A along with prudent risk management to deliver consistent results.

| · | Growth Highlights – Our balanced growth strategy has |

| o | Household growth increased 11% organically, 44% including mergers and acquisitions |

| o | Deposit growth increased 19% organically, 95% including mergers and acquisitions |

| o | Loan growth increased 34% organically, 115% including mergers and acquisitions |

| o | Our focus on business banking has led to a |

| o | Our focus on deepening relationships with current customers has led to organic growth as well. Since the beginning of 2014: |

| · | 240% increase in loan sales to current customers |

| · | 107% increase in deposit accounts sold to current customers |

| · | 85% increase in debit cards sold to current customers |

· Mergers and Acquisitions Highlights

| o | BankFIRST acquired October 2014 |

| · | IRR exceeded internal target of 19% |

| · | Household growth in acquired branches = +15% |

| · | Customer growth highlights |

| o | Avg Services = +29% |

| o | Consumer Installment Loans = +88% |

In determining whether a quorum exists at the Annual Meeting for purposes of all matters1 Non-GAAP measure; refer to be voted on, all votes “for” or “against,” as well as all abstentions and broker non-votes, will be counted.Appendix A “broker non-vote” occurs when a nominee does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner.- Informtion Regarding Non-GAAP Financial Measures.

| 4 |

On March 20, 2014, the record date, there were 25,985,761 shares of Common Stock issued, outstanding and entitled to be voted, which were held by approximately 1,560 holders of record. Therefore, at least 12,992,881 shares need to be present at the Annual Meeting or represented by proxy in order for a quorum to exist.

| o | Consumer Lines of Credit = +24% |

| o | Debit Cards = +15% |

| o | Mobile Banking = +294% |

| o | Grand Bank acquired July 2015 |

| · | IRR exceeded internal target of 24% |

| · | Household growth in acquired branches = 9% |

| · | Customer growth highlights |

| o | Avg Services = +12% |

| o | Debit Cards = +15% |

| o | Mobile Banking = +70% |

| o | Online Banking = +25% |

| o | Floridian Financial Group acquired March 2016 |

| · | Strengthened presence in Daytona and Orlando, along attractive I-4 Corridor |

| · | Compelling financial metrics announced and on track |

| · | Approximately 20% IRR |

| · | Tangible book value dilution earn back of 4.2 years |

| · | EPS accretion of $0.02 in 2016 |

| · | Acquisition closed and converted in March 2016 |

| o | BMO Harris Orlando Banking Operations acquired June 2016 |

| · | Further strengthened franchise in Orlando, including business banking |

| · | Compelling financial metrics announced and on track |

| · | IRR in excess of 20% |

| · | More than 6% accretive to 2016 EPS |

| · | Acquisition closed and converted in June 2016 |

| o | Full impact of cost savings were realized in Q4 2016 |

| o | Looking ahead, we anticipate further gains upon the successful integration of GulfShore Bancshares, which we expect to close during the second half of 2017. |

| · | Our conservative risk profile positions us well for sustainable value creation |

| o | While the total loan portfolio has grown by 138% since 2011, the average loan size has decreased by 42% in the same time period. We operate a granular, diversified loan portfolio. |

| o | The top 10 loan relationships represent 40% of total risk based capital, down by 35% since 2011 |

| · | Our approach to Commercial Real Estate is very different than our Florida peers |

| · | CRE loans as a percent of total capital remain relatively flat and intentionally below Florida peers, at 200% vs 271% for our peer group as of Q3 2016. |

| 5 |

Directors

Our methodical transformation continues with strong evidence of success and executive officerssignificant implications over time.

| · | Digital connectivity and big data are disrupting all industries, including community banking, ushering in the age of the customer. Customers are better informed and expect companies to revolve around them, not the other way around. Thus, convenience has been fundamentally redefined, to the benefit of banks that take advantage of transformational opportunities. |

| · | We recognized the implications early and, through efforts aimed at providing digital/electronic delivery to customers and through development of industry-leading technology and analytics, we have begun to drive growth and reduce costs. |

| o | Today more than 80% of everything being done at a Seacoast branch can be accomplished by mobile phone or ATM. We have invested in our 24/7 call center, ATMs, ATM capabilities and use of mobile, while consolidating our high fixed-cost branch network. |

| o | We continue to focus on driving routine transactions to lower cost channels and have made significant progress. We expect to process more routine transactions through non-branch channels (e.g. mobile, ATMs) than branch channels by the middle of 2017. Our ATMs and mobile app today process the equivalent servicing volume of 18 branches combined. |

| o | Over 30% of eligible consumer accounts are using Seacoast’s mobile app, following its launch only three years ago. |

| o | More than 37% of all physical checks are deposited outside the branch as of February 2017, up from 30% in February 2016, driven by steady adoption of mobile check deposit along with our ATM network. |

| o | Our progress in digital delivery is leading to tangible results for shareholders. Since year-end 2012, deposits have increased 99% while branches have only increased by 27%. This has led to a significant improvement in deposits per branch, now up to $75 million compared to $48 million at year-end 2012. |

The Florida Economy continues to provide tailwinds for our franchise.

| · | Florida is projected to be the 16th largest economy in the world in 2019 based on World Bank rankings. |

| · | Florida’s economy is accelerating at a faster pace than the nation for next four years and becoming a $1 trillion economy in 2018 |

| · | Florida surpassed New York in 2014 to become the nation’s third largest state. |

| · | Florida is also among the nation’s top ten fastest growing states. |

| · | Florida offers a diversified economy, with growth in education, health services, leisure & hospitality, trade, transportation, utilities, construction and manufacturing. |

We have a skilled and engaged employee base, with multiple awards over the Company beneficially hold approximately 6,593,999 shares of Common Stock, or 25.3 percent of all the votes entitled to be cast at the Annual Meeting.past year.

| · | Our Director of Business Technology & Data Management was recognized by Ventana Research as a Business Technology leadership award winner in Business Intelligence. |

| 6 |

| · | Our Digital Marketing Manager was recognized by Google as a success story and also recognized as one of three Social Media Leaders of 2016 by Independent Banker Magazine. |

| · | We’ve been granted two provisional patents based on innovation developments by our analytics and technology teams. |

And our focus on customers is what makes us special.

| · | 90 years of experience has firmly established our brand and allowed us to hone our convenience service model. |

| · | Our customer satisfactions scores remain high. 76% of our consumer customers have recommended Seacoast to a friend, and 78% of our small business customers have done so as well. |

| · | Gallup indicates that “a customer who is fully engaged represents an average 23%premium in terms of share of wallet, profitability, revenue, and relationship growth compared with the average customer. In stark contrast, an actively disengaged customer represents a 13%discount in those same measures.”1 |

Q: What if a quorum is not present at the Annual Meeting?Executive Compensation Program Highlights

A: If a quorumThe Compensation and Governance Committee (“CGC”) is not present atcommitted to aligning our compensation strategies with the scheduled timeneeds of our evolving business strategy, good governance and effective risk management practices, and our efforts to generate superior returns for our long-term shareholders. To this end, we emphasize pay-for-performance emphasis in our executive compensation programs and, ultimately, the Annual Meeting, a majorityalignment of the shareholders present or represented by proxy may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned Annual Meetingmanagement with shareholder interests. Significant value only will be announced at the time of the adjournment,realized if any,we exceed our long-term performance expectations and nodeliver meaningful value creation for our shareholders.

Our executive compensation strategy strongly aligns our CEO and other notice will be given. An adjournment will have no effect on the business that may be conducted at the Annual Meeting. If the Annual Meeting is adjourned more than 120 days after the date fixed for the original Annual Meeting, the Board of Directors must fix a new Record Date to determine the shareholders entitled to vote at the adjourned Annual Meeting.executives with long-term shareholder interests.

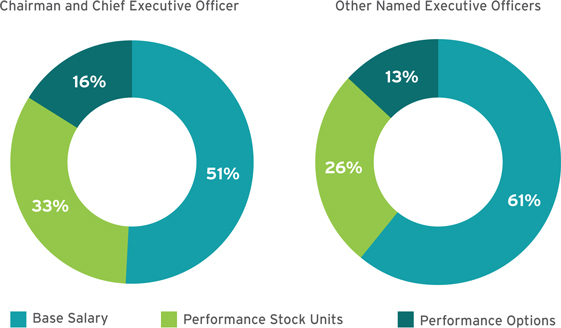

| · | Base salary is the sole form of fixed compensation. For our CEO, base salary represents approximately one-half of total pay. |

| · | In general, variable or “at risk” pay approximates or exceeds greater than one-half of the pay for our named executive officers. |

| · | All incentive compensation for FY16 performance was paid in the form of equity awards granted in April 2017. |

| · | The majority of our variable pay opportunity is delivered as performance-based stock that only can be earned if we attain or exceed minimal levels of acceptable financial or market-based goals, as approved by the CGC. |

| · | Performance-based stock is our primary form of incentive compensation, ensuring that pay outcomes closely align with shareholder returns. |

1 Gallup Business Journal, July 22, 2014

| 7 |

Q: What is the recommendation of the Board of Directors with regard to each proposal?Program Changes in 2016

| · | Introduction of individual performance scorecards for all of our executives which, among other things, included our EPS performance goal of $1.00. |

| · | Short-term cash bonuses for FY16 performance were replaced with performance-based stock awards for the CEO and performance-contingent stock awards for the other executive officers, which were granted in April 2017. The CGC took this action in response to guidance we received from our shareholders that they would like management to increase their direct ownership in the Company and to enhance the holding power (retention) and risk sensitivity of our incentive strategies. |

A:

Please refer to theCompensation Discussion and AnalysisandThe Executive Compensation Tables in this proxy statement for additional details.

Summary of Voting Matters and Board of Directors of Seacoast believes the proposals described herein are in the best interests of the Company and its shareholders and, accordingly, unanimously recommends that shareholders vote as follows:Recommendations

| Item | Proposal | Recommendation | Vote Required |

| 1 | Election of Four Class III Directors | FOR ALL | Plurality vote* |

| 2 | Ratification of Appointment of Crowe Horwath LLP as Independent Auditor for 2017 | FOR | Affirmative vote of a majority of votes cast |

| 3 | Advisory (Non-binding) Vote on Executive Compensation (Say on Pay) | FOR | Affirmative vote of a majority of votes cast |

* More fully described in Proposal 1 - Election of Directors, Manner of Voting Proxies

| 8 |

Q: What options do I have in voting on each proposal?Our Director Nominees

A: Except with respect to Proposal 1 for the election of directors, you may vote “for,” “against,” or “abstain” on each proposal properly brought before the Annual Meeting. In the election of directors, you may vote “for” or “withhold authority” to vote for each nominee.

Q: WhatYou are the voting requirements with regard to each proposal?

A: Under our Bylaws, all elections of directors are decided by plurality vote. However, notwithstanding the plurality standard, in an uncontested election for directors, which is the case for the election under Proposal 1, our Corporate Governance Guidelines provide that if any director nominee receives a greater number of votes “withheld” from his or her election than votes “for” such election, then the director will promptly tender his or her resignation to the Board following certification of the shareholder vote, with such resignation to be effective upon acceptance by the Board of Directors. The Compensation and Governance Committee would then review and make a recommendation to the Board of Directors as to whether the Board should accept the resignation, and the Board would ultimately decide whether to accept the resignation. The Company will disclose its decision-making process regarding the resignation in a Form 8-K furnished to the SEC. In contested elections, the required vote would be a plurality of votes cast and the resignation policy would not apply. Full details of this policy are set forth in our Corporate Governance Guidelines, available on our website atwww.seacoastbanking.net.

Proposals 2 and 3 require approval by the affirmative vote of a majority of votes cast at the Annual Meeting.

Our Board of Directors unanimously recommends that you vote “FOR” Proposals 1, 2 and 3.

Unless otherwise required by the Company’s Amended and Restated Articles of Incorporation, as amended (“Articles of Incorporation”), our Bylaws, the Florida Business Corporation Act, or by applicable law, any other proposal that is properly brought before the Annual Meeting will require approval by the affirmative vote of a majority of all votes cast at the Annual Meeting.

Please remember that Proposals 1 and 3 are each considered non-routine matters. As a result, if your shares are held by a broker or other fiduciary, your shares cannot be voted on these matters unless you have provided voting instructions to your broker or other nominee.

Abstentions and broker non-votes, if any, will not be counted for purposes of determining whether any of the proposals have received sufficient votes for approval, but will count for purposes of determining whether or not a quorum is present. So long as a quorum is present, abstentions and broker non-votes will have no effect on any of the matters presented for a vote at the Annual Meeting.

Q: What is “householding” and how does it affect me?

A: The SEC permits delivery of one copy of the proxy materials to shareholders who have the same address and last name under a procedure referred to as “householding”. We do not utilize householding for our shareholders of record. However, if you hold your shares through a broker, bank or other nominee, you may receive only one copy of the Notice and, as applicable, any additional proxy materials that are delivered.

If you receive a single set of proxy materials as a result of householding, and you would like to have separate copies of proxy materials mailed to you in the future, please contact your broker, bank or other nominee. However, if you want to receive a paper proxy or Notice or other proxy materials for purposes of this year’s Annual Meeting, follow the instructions included in the Notice that was sent to you, or as indicated above under “What if I prefer to receive paper or email copies of the materials?”

Q: Who will pay the expenses of the proxy solicitation?

A: The Company will bear the cost of preparing, printing and mailing the proxy materials and soliciting proxies for the Annual Meeting. In addition to the solicitation of shareholders of record by mail, telephone, electronic mail, facsimile or personal contact, Seacoast will be contacting brokers, dealers, banks, and/or voting trustees or their nominees who can be identified as record holders of Common Stock; such holders, after inquiry by Seacoast, will provide information concerning quantities of proxy materials needed to supply such information to beneficial owners, and Seacoast will reimburse them for the reasonable expense of mailing proxy materials. Seacoast may retain other unaffiliated third parties to solicit proxies and pay the reasonable expenses and charges of such third parties for their services.

Q: Where do I find the voting results of the Annual Meeting?

A: If available, we will announce voting results at the Annual Meeting. The voting results will also be disclosed on a Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 21, 2014.

The Notice of Annual Meeting, the 2014 Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2013 are available at:

www.proxyvote.com

PROPOSAL 1ELECTION OF DIRECTORS

General

As of the date of this proxy statement, Seacoast’s Board of Directors consists of fourteen members divided into three classes, serving staggered three year terms as provided in our Articles of Incorporation.

The Annual Meeting is being heldasked to, among other things, re-electproposals, elect four Class III directors of Seacoast, elect two Class II directors and elect one Class III director, each of whom has been nominated by the Compensation and Governance Committee of the Board of Directors.Seacoast. All of the nominees, except Alvaro Monserrat, are presently directors of Seacoast andSeacoast. All of the nominees also serve as members of the Boardboard of Directorsdirectors of Seacoast’s principal banking subsidiary, Seacoast National Bank (the “Bank”). The membersAlvaro J. Monserrat has been nominated by Seacoast’s Board to replace T. Michael Crook, who intends to retire from the Company’s Board at the end of the Boards of Directors of the Bank and the Company are the same except for John H. Crane, who is currently a director of the Bank only.Annual Meeting. If re-elected,elected, each Class III director nominee will serve a three year term expiring at the 20172020 Annual Meeting and until their successors have been elected and qualified. Detailed information about each nominee’s background, skills and expertise can be found inProposal I – Election of Directors.

On September 17, 2013, the Board of Directors, following the recommendation of our Compensation and Governance Committee, elected Dennis J. Arczynski as a director, effective immediately, replacing John H. Crane who retired from the Company’s Board in July 2013. Mr. Arczynski has been a director of the Bank since 2007. Mr. Crane remains on the Board of Directors of the Bank. Mr. Arczynski will stand for election as a Class II director at the Annual Meeting, and, if elected, Mr. Arczynski will serve for a term expiring at the 2016 Annual Meeting, along with the other Class II directors.

| Name | Age | Director Since | Current Occupation | Independent | No. of Other Public Boards |

| Stephen E. Bohner | 64 | 2003 | President and owner of real estate company | ü | 0 |

| Alvaro J. Monserrat | 48 | new | CEO of a leading digital workspace technology company | ü | 0 |

| Julie H. Daum | 62 | 2013 | Senior director of national executive and board search firm | ü | 0 |

| Dennis S. Hudson, III | 61 | 1984 | Chairman of Company and Bank | 2 |

On October 15, 2013, the Board of Directors, following the recommendation of our Compensation and Governance Committee, increased the size of the Board from twelve to thirteen directors and appointed Julie H. Daum as a director to immediately fill the vacancy on the expanded Board. Ms. Daum will stand for election as a Class III director at the Annual Meeting, and, if elected, will serve for a term expiring at the 2017 Annual Meeting, along with the other Class III directors.

On February 24, 2014, the Board of Directors, following the recommendation of our Compensation and Governance Committee, increased the size of the Board from thirteen to fourteen directors and appointed Maryann B. Goebel as a director to immediately fill the vacancy on the expanded Board. Ms. Goebel will stand for election as a Class II director at the Annual Meeting, and, if elected, will serve for a term expiring at the 2016 Annual Meeting, along with the other Class II directors.

Currently, the Board of Directors is classified as follows:

| ||||

|

| 9 |

Manner for Voting Proxies

All shares represented by valid proxies, and not revoked before they are exercised, will be voted in the manner specified therein. If a valid proxy is submitted but no vote is specified, the proxy will be votedFOR the election of each of the seven nominees for election as directors. Please note that banks and brokers that do not receive voting instructions from their clients are not able to vote their client’s shares in the election of directors. Although all nominees are expected to serve if elected, if any nominee is unable to serve, then the persons designated as proxies will vote for the remaining nominees and for such replacements, if any, as may be nominated by Seacoast’s Compensation and Governance Committee. Proxies cannot be voted for a greater number of persons than the number of nominees specified herein (seven persons). Cumulative voting is not permitted.

The affirmative vote of the holders of shares of Common Stock representing a plurality of the votes cast at the Annual Meeting at which a quorum is present is required for the election of the directors listed below. However, to provide shareholders with a meaningful role in uncontested director elections, which is the case for the election of the director nominees listed below, our Corporate Governance Guidelines provide that if any director nominee receives a greater number of votes “withheld” for his or her election than votes “for” such election, then the director will promptly tender his or her resignation to the Board following certification of the shareholder vote, with such resignation to be effective upon acceptance by the Board of Directors. The Compensation and Governance Committee would then review and make a recommendation to the Board of Directors as to whether the Board should accept the resignation, and the Board would ultimately decide whether to accept the resignation. The Company will disclose its decision-making process regarding the resignation in a Form 8-K furnished to the SEC. In contested elections, the required vote would be a plurality of votes cast and the resignation policy would not apply. Further details of this policy and the corresponding procedures are set forth in our Corporate Governance Guidelines, available on our website at www.seacoastbanking. net.

The seven nominees have been nominated by Seacoast's CompensationBoard and Governance Committee, and the Board of Directors unanimously recommends a vote “FOR” the election of all seven nominees listed below.Highlights

Nominees to be Elected at the Annual MeetingINFORMATION ABOUT OUR CURRENT BOARD COMMITTEE MEMBERSHIP AND 2016 COMMITTEE MEETINGS

|

|

Mr. Arczynski’s other positions of responsibility with the OCC included Assistant Director for Trust Operations, Special Assistant to the Senior Deputy Comptroller (FFIEC Liaison), Associate Director for Financial Management (Financial and Systems Review) and Field Office Manager (Miami Field Office). His duties included the formation of national policies and programs, development of OCC supervisory initiatives, establishment of interagency relations, drafting regulations and writing OCC examiner handbooks.

In making the determination that Mr. Arczynski should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications, as well as:

| Director Name | Audit | Compensation & Governance | Enterprise Risk Management | Strategy & Innovation |

| Dennis J. Arczynski(1) | X | X(2) | X | |

| Stephen Bohner(1) | X | |||

| Jacqueline L. Bradley(1) | X | |||

| T. Michael Crook | X | |||

| H. Gilbert Culbreth, Jr.(1) | X(2) | |||

| Julie H. Daum(1) | X | |||

| Christopher E. Fogal(1) | X(2) | |||

| Maryann Goebel(1) | X | X | X | |

| Roger O. Goldman(1) (3) | ||||

| Dennis S. Hudson, Jr. | X | |||

| Dennis S. Hudson, III(4) | X | |||

| Timothy S. Huval(1) | X | |||

| Herbert A. Lurie | X | |||

| Alvaro J. Monserrat | X | |||

| Thomas E. Rossin(1) | X | X(2) | ||

| TOTAL MEETINGS HELD | 9 | 8 | 5 | 7 |

|

|

In making the determination that Mr. Bohner should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

|

|

Mr. Crook’s professional affiliations include the American Institute of Certified Public Accountants, the Management Advisory Services Division of the American Institute of Certified Public Accountants, and the local legislative contact for the Florida Institute of Certified Public Accountants.

In making the determination that Mr. Crook should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

|

|

A widely renowned expert on corporate governance topics, Ms. Daum was recognized by the National Association of Corporate Directors’ (“NACD”) as one of the top 100 most influential leaders in corporate governance in 2013. She also advises corporate boards on succession planning for themselves and their CEOs, as well as best practices and governance issues. Each year, Ms. Daum develops the Spencer Stuart Board Index, a publication detailing trends at national boardrooms. She also co-founded and developed a program for board members entitled “Fresh Insights and Best Practices for Directors” at the Wharton School of the University of Pennsylvania, where she earned her MBA.

In making the determination that Ms. Daum should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications and her qualification as an independent director, as well as:

|

|

In her 40+ year career, Ms. Goebel has shaped the strategic direction of information technology for major corporations around the world, serving in the critical role of chief information officer for: DHL Express from 2006 to 2009; General Motors North America from 2003 to 2006; General Motors Europe from 1999 to 2001; General Motors Truck Group from 1997 to 1999; Bell Atlantic NYNEX Mobile (now Verizon Mobile) from 1995 to 1997; and Frito-Lay from 2001 to 2002. She has also held senior IT leadership positions at Texas Instruments, Inc., Aérospatiale Helicopter Corporation, and the Southland Corporation, among others. Ms. Goebel received the “100 Leading Women in the North American Auto Industry” award in 2005. She has also been given an award for outstanding professional achievement from her alma mater, Worcester Polytechnic Institute, where she earned a Bachelor of Science degree in mathematics.

In making the determination that Ms. Goebel should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications and her qualification as an independent director, as well as:

| (2) |

|

Mr. Hudson is actively involved in the community, having served on the boards of the Martin County YMCA Foundation, Council on Aging, The Pine School, the Job Training Center, American Heart Association, Martin County United Way, the Historical Society of Martin County and as chairman of the board of the Economic Council of Martin County, on which he still serves. He has been recognized for his achievements with several awards including the Florida Senate Medallion of Excellence Award presented by Florida Senator Ken Pruitt in 2001. Mr. Hudson is a graduate of Florida State University with dual degrees in Finance and Accounting, and a Master’s degree in Business Administration.

In making the determination that Mr. Hudson should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications, as well as:

|

|

In making the determination that Mr. Walpole should be a nominee for director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

Directors Whose Terms Extend Beyond the Annual Meeting

|

|

Mr. Culbreth is a former director of the Florida Council on Economic Education, the Okeechobee County Board of Realtors, the Okeechobee Economic Council, and the United Way of Okeechobee and is a member of the Masonic Lodge.

In making the determination that Mr. Culbreth should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

|

|

In making the determination that Mr. Fogal should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

|

|

| (4) | Chairman of |

From 1997Director Attendance:All directors attended over 75% or more of the meetings of the Board andBoard committees on which they served in 2016.

| 10 |

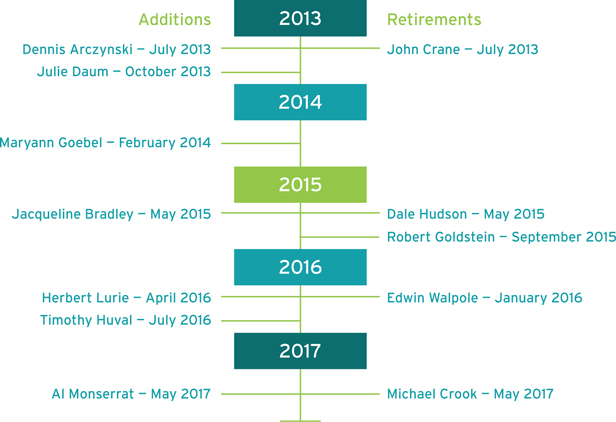

Over the past four years, we have continually recruited new talent to 2000, Mr. Goldman was presidentour Board to increase diversity of thought and chief executive officerexperience and to better align overall Board capability with our strategic focus. During this time, our Chairman/CEO and our Lead Independent Director have focused considerable attention on Board refreshment and we have added six new directors (seven should Alvaro Monserrat be elected at the Annual Meeting) with skill sets needed to help navigate the fast-changing environment impacting our business. As a result, our overall Board composition has been significantly altered across a number of Global Sourcing Services, LLC,important aspects creating a start-up venture specializingvibrant Board culture and unrelenting focus on creating shareholder value over the long term.

Below is a graphic illustration of the changes in outsourced marketing services and account acquisition and customer retention programs, which he grew to a substantial size before it was sold.our Board over the past four years:

Seacoast Board of Directors

| 11 |

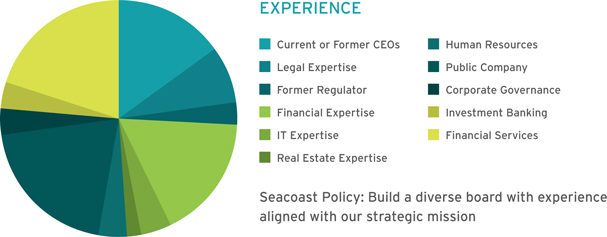

Currently, our board has the following characteristics:

1 AEBFSB has entered into various consent orders with each of the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau regarding certain compliance related matters that AEBFSB should resolve. AEBFSB also paid certain civil money penalties, established a segregated fund to provide remediation to certain customers and agreed to make certain enhancements to its compliance and vendor oversight programs.

Mr. Goldman’s extensive banking experience also includes management positions at Citicorp from 1969 to 1983; service as president and chief executive officer of Redwood Bank, a community bank in San Francisco, California, from 1983 to 1986; executive vice president and senior operating officer of Coreast Savings Bank from 1989 to 1991; and executive vice president in charge of the community banking group of NatWest Bancorp (with $31 billion in assets) from 1991 to 1996 where he was responsible for managing all consumer and small business activities. In addition, he previously served on the boards of several public and private corporations, including Minyanville (a new media company), Cyota (an Internet security company), and American Express Centurion Bank, where he also served as a member of the audit committee. He is Chairman Emeritus of the Lighthouse International, a charitable foundation for the visually impaired which is headquartered in New York, and is the former Chairman of the Juvenile Diabetes Research Foundation. Mr. Goldman received his Bachelor’s degree from New York University in Marketing and his Juris Doctorate from the Washington College of Law at American University. He is an emeritus member of the New Jersey bar and former member of the Washington D.C. bar.

In making

Since 2013, we have managed the determination that Mr. Goldman should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

Board talent pipeline and:

| · |

|

|

Mr. Goldstein is also currently a director of FNB Corporation (since 2003), a member of their executive committee and chairman of their compensation committee; is a director of Hampton Roads Bankshares (since 2010) and a member of their compensation, governance/nominating, and risk oversight committees; and is lead director of Palmetto Bancshares, Inc. and a member of the board of its banking subsidiary, Palmetto Bank (since 2010) and member of their credit and governance/nominating committees. Mr. Goldstein is also chairman of the board of directors of THE BANKshares, Inc., a member of the audit, ALCO, compensation and executive committees of THE BANKshares, Inc., and a director of its banking subsidiary, BankFIRST, since 2007. Mr. Goldstein’s other senior executive and director experience includes service as director and chairman of the executive committee of Great Lakes Bancorp from 2005 to 2006; chairman of the board and chief executive officer of Bay View Capital Corporation, a $6 billion bank holding company, from 2001 to 2006; director of Cobalt Holdings, LLC (an accredited credit rating agency and asset management company) from 2003 to 2010, as well as numerous other executive and/or director positions with financial institutions over a career that has spanned 50 years. Mr. Goldstein is nationally recognized for his expert investing and operational experience in turning around and implementing growth strategies for banks under the most challenging circumstances.

Mr. Goldstein’s appointment to the Board of Directors is pursuant to the Stock Purchase Agreement (the “Stock Purchase Agreement”), dated October 23, 2009, between Seacoast and CapGen Capital Group III LP (“CapGen LP”), an affiliate of CapGen LLC. CapGen LP purchased 6,000,000 shares of our Common Stock on December 17, 2009 for $13.5 million pursuant to the Stock Purchase Agreement. Under the Stock Purchase Agreement, CapGen LP is entitled to appoint one director to our Board of Directors as long as CapGen LP or an affiliate retains ownership of the shares purchased under the agreement.

Although Mr. Goldstein’s directorships on outside boards exceed the number specified in the Company’s Corporate Governance Guidelines, the Compensation and Governance Committee currently believes that the number of directorships is acceptable since Mr. Goldstein’s full-time job is to represent and provide expertise to boards of the banks in which CapGen LLC and its affiliates invest, and his directorships on these boards were approved by the Federal Reserve.

In making the determination that Mr. Goldstein should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

|

|

Mr. Hudson has also devoted 19 years of service as chairman of Mary’s Kitchen, a local soup kitchen for the homeless. He has received numerous awards and honorary titles, including the first Martin County Citizen of the Year Award by the March of Dimes in 1995 and the National Philanthropy Award with his wife in 2006.

In making the determination that Mr. Hudson should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications, as well as:

|

|

In making the determination that Mr. Hudson should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications, as well as:

|

|

Prior thereto, Mr. Rossin was vice chairman and director of First Bancshares of Florida, Inc. after consolidating four banks under one charter, including First National Bank in Riviera Beach at which he served as president and chief executive officer. He has served as past president of the Community Bankers Association of Florida and Palm Beach County Bankers Association, and is a member of the Palm Beach County Bar Association, American Bar Association and the Florida Bar Association. In March 2014, Mr. Rossin received the Exemplary Elected Official Award from the Forum Club of the Palm Beaches.

In making the determination that Mr. Rossin should remain a director of Seacoast, the Compensation and Governance Committee considered these qualifications and his qualification as an independent director, as well as:

| · |

| · |

Non-Director Executive OfficersShould Alvaro Monserrat be elected at the Annual Meeting, we will have reduced the average tenure of our non-executive directors from 13.7 years to 9.5 years and decreased the average age by nearly 6.8 years.

| 12 |

Our Board is committed to identifying, appointing and developing directors who reflect the diverse profiles of our existing and prospective customers, have experience and expertise aligned with our strategic objectives, and who can add significant value to the Board’s efforts to oversee Seacoast on behalf of our shareholders. Constructing an effective Board and positioning it for success are key objectives for Seacoast. Under our Independent Lead Director Goldman’s guidance, we have made significant progress in expanding the experience of the Board. These outcomes have increased overall Board effectiveness while increasing its agility and the velocity of decision making, which are critical inputs in the governance process. Under Mr. Goldman’s leadership, the Board is well-positioned to fulfill its duties to our shareholders and meet the evolving needs of Seacoast.

| 13 |

|

|

CORPORATE GOVERNANCE

Corporate Governance Framework

| Board Independence | · · Our CEO is the only member of management who serves as a director. |

| Board | · · We have a mix of new and longer tenured directors to help ensure fresh perspectives as well as continuity and experience. The average tenure of our non-management directors is 9.5 years. · In the event that director nominee Monserrat is elected to the Board, |

| Board Committees | · We have · The Audit Committee and · Chairs of the committees shape the agenda and information presented to their committees. |

| Strong Independent Lead Director | · Our independent directors elect an independent lead director. · Our independent lead director chairs regularly scheduled executive sessions, without management present, at which directors can discuss management performance, succession planning, board · Our lead independent director strongly influences our strategy and direction, and facilitates our annual strategic planning sessions. |

| Board Oversight of Strategy & Risk | · Our Board · Our Board directly advises management on development and execution of the company’s strategy and provides oversight through regular updates. · The S&I Committee helps ensure that the strategic vision for the Company is fulfilled by challenging, proposing, reviewing, and monitoring strategic initiatives of the Company relating to M&A activity, capital allocation and planning, business model transformation, innovation, and shareholder relations. · Through an integrated enterprise risk management process, key risks are reviewed and evaluated by the · The ERMC oversees the integration of risk management at Seacoast, monitors the risk framework and makes recommendations to the Board regarding the Company’s risk appetite. · The Audit Committee oversees the Company’s financial risk management process. · The · The

|

| Accountability | · We have a plurality vote standard for the election of directors, with a director resignation policy for uncontested elections. · Each common share is entitled to one vote. · |

| Director Stock Ownership | · A |

| Succession Planning | · CEO and management succession planning is one of the Board’s highest priorities. Our Board ensures that appropriate attention is given to identifying and developing talented leaders. |

| Board Effectiveness | · Our Board strives to continually improve its effectiveness. · The Board meets in a director-only session prior to each regular meeting to discuss the Company’s business condition. Each regular meeting is followed by an executive session of non- management directors led by the lead independent director. · The Board and its independent committees annually evaluate their performance. |

| Open Communication | · Our Board · Our directors have access to all management and employees on a confidential basis. · Our Board and its committees are authorized to hire outside consultants at their discretion and at the Company’s expense. |

| 14 |

| CORPORATE GOVERNANCE AT SEACOAST |

Our goal is to maintain a corporate governance framework that supports an engaged, independent board with diverse perspectives and judgment that is committed to representing the long-term interests of our shareholders. We believe our directors should possess the highest personal and professional standards for ethics, integrity and values, as well as practical wisdom and mature judgment. Therefore, our Board, with the assistance of management and the CGC, regularly reviews our corporate governance principles and practices.

Corporate Governance Principles and Practices

Important elements of our corporate governance framework are our governance policies, which include:

| · | our Corporate Governance Guidelines |

| · | our Code of Conduct (applicable to all directors, officers and employees) |

| · | our Code of Ethics for Financial Professionals (applicable to, among others, our chief executive officer and chief financial officer); and |

| · | charters for each of our Board Committees |

You may view these and other corporate governance documents at our investor relations website located at www.SeacoastBanking.com, or request a copy, without charge, upon written request to Seacoast Banking Corporation of Florida, c/o Corporate Secretary, 815 Colorado Avenue, P. O. Box 9012, Stuart, Florida 34995.

| Our governance principles provide that a substantial majority of our directors will meet the criteria for independence required by Nasdaq. If director nominee Monserrat is elected by our shareholders at the Annual Meeting, over 78% of our Board will meet our criteria for independence. |

The Company’s Common Stockcommon stock is listed on the Nasdaq Global Select Market (“Nasdaq”). Nasdaq requires that a majority of the Company’s directors be “independent,” as defined by the Nasdaq’sNasdaq rules. Generally, a director does not qualify as an independent director if the director (or, in some cases, a member of the director’s immediate family) has, or in the past three years had, certain relationships or affiliations with the Company, its external or internal auditors, or other companies that do business with the Company. The Board of Directors has determined that a majority of the Company’s directors are independent directors under the Nasdaq rules. The Company’s current independent directors are: Dennis J. Arczynski, Stephen E. Bohner, T. Michael Crook,Jacqueline L. Bradley, H. Gilbert Culbreth, Jr., Julie H. Daum, Christopher E. Fogal, Maryann Goebel, Roger O. Goldman, Robert B. Goldstein,Timothy S. Huval and Thomas E. Rossin, and Edwin E. Walpole, III.Rossin.

| 15 |

| Board leadership is provided through: 1) a combined Chairman and CEO role, 2) a clearly defined and substantial lead independent director role, 3) active committees and committee chairs, and 4) talented directors who are committed and independent-minded. At this time, the Board believes this governance structure is appropriate and best serves the interests of our shareholders. |

Chairman and CEO Roles

The Chairman of the Board of Directors provides leadership to the Board of Directors and works with the Board of Directors to define its structure and activities in the fulfillment of its responsibilities. The Company believes that the members of the Board of Directors possess considerable experience and unique knowledge of the challenges and opportunities the Company faces, and therefore are in the best position to evaluate the needs of the Company and how to best organize the capabilities of the Company’s directors and executives to meet those needs. As a result, the Company believes that the decision as toperiodically assesses who should serve as Chairman and as Chief Executive Officer, and whether the offices should be combined or separate, is properly the responsibility of the Board of Directors, to be exercised from time to time inwith appropriate consideration of then-existingcurrent facts and circumstances.

The Company’s current Chief Executive Officer, Dennis S. Hudson, III, also serves as the Chairman of the Board of Directors. He has held the post of Chief Executive Officer for the past 1619 years, Chairman for the past nine12 years, President for the eightnine years prior to being named Chairman, and has also served as Chief Executive Officer of the Bank for the past 2124 years. During this time, Mr. Hudson has led the Company through its growth from a local community bank to an institutionthe fourth largest Florida bank with $2.3nearly $4.7 billion in assets and 3449 full-service branches and five Accelerate business officescommercial banking centers in 12 counties.15 counties today. In light of Mr. Hudson’s significant leadership tenure with the organization, his breadth of knowledge of the Company and his relationship with the institutional investor community, as well as the efficiencies, accountability, unified leadership and cohesive corporate culture that this structure provides, the Board of Directors believes it is appropriate that he serve as both Chief Executive Officer and Chairman.

Independent Lead Director

To further strengthen our corporate governance environment, our independent directors select a lead director from the independent directors if the positions of Chairman and Chief Executive Officer are held by the same person or if the Chairman of the Board is not an independent director. The lead director: coordinates the activitiesrole of the independent directors; collaborates with and makes recommendations to the CEO in setting Board meeting agendas; serves as an ex-officio member of each committee of the Board if not otherwise a member of the committee; reviews responses to director shareholder communications with the Board and if requested by a major shareholder or the CEO,our Lead Independent Director is available for consultation or direct communication; prepares the agenda for executive sessions of the independent directors and chairs those sessions; and is primarily responsible for communications between the independent directors and the CEO. A more complete description of the lead director’s role is containeddescribed in our Corporate Governance Guidelines and availablein the table at the end of this section.

Our current Lead Independent Director is Mr. Roger Goldman. He has served in this capacity since 2012. Mr. Goldman’s experience includes a number of high profile leadership assignments at or on behalf of shareholders or other constituent groups at organizations significantly larger than Seacoast. The depth and breadth of his experience and his willingness and capacity to dedicate a significant portion of his time on behalf of the Company’s website at www.seacoastbanking.net. Roger O. Goldman was selected as Lead DirectorBoard and our shareholders are key inputs in November 2012.our transformative efforts. We aspire to be a significantly larger organization. Our ability to attain our aspirations depends heavily on our success in developing and implementing innovative products and services that are easily accessible, secure, and that make a meaningful difference to our customers. His vision for our future and his “operator” level understanding of the required strategies, investments, talent needs, capabilities, infrastructure and the associated risks provide our Board with an independent and objective perspective on our management.

| 16 |

Executive SessionsMr. Goldman’s affiliation with Seacoast enhances our reputation within the industry, improves the performance and effectiveness of the Board, and enhances our exposure with the investment community. He is uniquely suited to lead the Board during the normal course of business and in its day-to-day interactions with and oversight of management.

In addition to Mr. Goldman’s efforts to ensure an effective and results-oriented Board, he engages on the Board’s behalf with management and employees across the Company. Frequent active, independent, and effective engagement by Mr. Goldman aids our Board of Directors in making informed decisions on our business and risk strategies. He also is well-positioned to assess our executive and managerial talent, succession readiness plans, and leadership development efforts, which are key to our success. Finally, his accessibility and high level of visibility within the Company provides employees with ongoing opportunities to raise issues or concerns free from management’s direct influence. Mr. Goldman provides a wide array of highly valuable services to Seacoast. We believe the associated replacement costs if he were to step down from the Lead Independent Director role are significantly greater than the costs that we would incur to engage a replacement to replicate the services he provides to the Board and our shareholders.

Mr. Goldman devotes significant time to serving as our Lead Independent Director. While the structure of his role and scope of responsibilities are significantly greater than most other US companies, we view his contributions and level of commitment as material to the Company’s success. In order to induce Mr. Goldman to accept the role of Lead Independent Director and ensure that he is paid appropriately for his contributions and time, the Board of Directors approved a compensation package that is discussed below in the “Director Compensation” section under “Lead Independent Director Compensation and Agreement.”

| 17 |

BOARD LEADERSHIP STRUCTURE - DEFINITION OF ROLES

| Lead Independent Director Role | Chair/CEO Role | |

| Full Board Meetings | ||